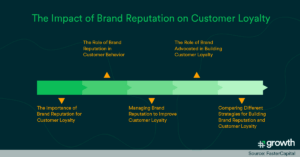

Retaining customers isn’t just about making them buy again; it’s about building long-term loyalty. You need to prevent your customers from switching to your competitors. The real question is: What does it take to please customers—and keep them coming back?

Is it your product’s uniqueness? Is it your service quality? Why would customers voluntarily pay for your offering again and again? The answer is more layered than you think.

In this guide, we’ll examine seven examples of customer retention and what brands are doing right to build and retain a loyal customer base.

Why Customer Retention Matters

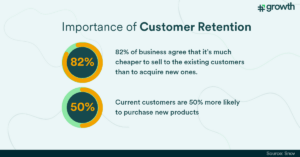

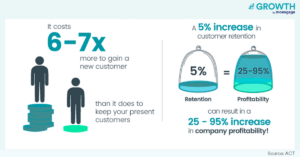

Think about it: What’s more profitable? A single customer buying several times from your brand over one year or multiple shoppers buying from you but never returning again? We’d bet on the former.

If you are able to retain customers, they will purchase more frequently, recommend the brand to others, actively choose your brand over competitors, and even pay a premium. The foundation of all these elements lies in how loyal your customers are.

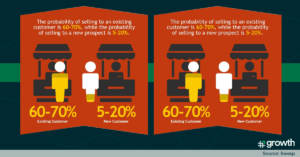

On the company side, selling to an existing customer is 60-70% profitable as opposed to selling to a new prospect:

The takeaway: Retaining existing customers is as important as getting new ones through the door. The best to turn on the loyalty switch is by identifying loyal customers through RFM segmentation and using robust referral campaigns.

7 Winning Customer Retention Campaigns (+ Key Takeaways)

You may equate customer retention campaigns with loyalty programs, but that’s just the tip of the iceberg. Successful brands understand that customer retention starts with making customer data their single source of truth and moving on to reimagining the customer experience with said data.

Here are seven examples of customer retention that target existing customers using different touch points and brand advocacy strategies:

Strategy #1: Create customer profiles and send continuous, personalized messaging

You can’t convert customers to be brand advocates if you don’t:

A. Know them, including what they like, dislike, need, aspire for, and so on

B. Understand where they are in their buying journey

This is where customer personas or profiles come in. You gather information about your customers, segment it based on shared preferences/needs, and tailor your marketing accordingly.

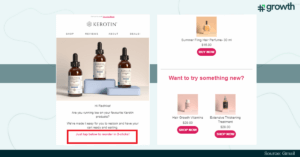

In action, this looks something like the following email from the brand Kerotin:

Source: Screenshot from Gmail

This email gets many things right in the first go:

- Retargets an existing customer after weeks of the first purchase to see if the customer is running low on products.

- Makes it easy for the customer to buy their favorite product with just two clicks.

- Recommends new products that the customer might like.

- Reflects simplicity, as the email is to the point and the design is clutter-free.

The takeaway: Developing a profile of your long-term customers enables you to leverage this profitable segment. By closely monitoring their preferences, you can increase the likelihood of turning them into a loyal customer base. Analyze what sets your repeat customers apart from one-time buyers, and use this insightful data for marketing to existing customers in a targeted way.

Strategy #2: Make your existing customer’s happiness and convenience your priority

On paper, this seems like an obvious theory. But in practice, brands often stop following through on this crucial strategy.

They get caught up in chasing new leads and neglect the potential goldmine of existing customers.

Here’s how you can maintain a balance between your customer retention efforts and your acquisition strategies:

Work on exceeding existing customer expectations in addition to meeting the expectations of new customers

Connect with existing customers on shared values and build loyalty with new customers, demonstrating your brand’s core values as Toms’ does:

Customer loyalty guru Fred Reichheld, in his book Winning on Purpose, summarizes:

“The primary purpose of a business should be to enrich the lives of its customers. Because when customers feel this love, they come back for more and bring their friends—generating good profits.”

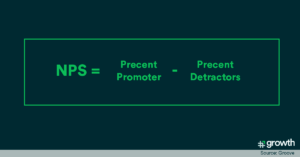

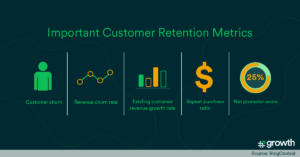

He suggests brands use the Earned Growth Rate (EGR) to measure the revenue growth brought on by returning customers and their referrals. Using this metric alongside NPS will give a hard financial metric to assess loyalty-driven growth.

The takeaway: You can prioritize your loyal customer’s happiness in many ways—you can go the extra mile to address their pain-point, make it easier for them to shop with you, enable them with discounts and rewards for their continued loyalty, and more. Elevate this strategy by anticipating what would make your existing customers happy instead of waiting for them to knock on your door.

Strategy #3: Show customers how your brand values them—with meaningful words of affirmation

When it comes to showcasing customer loyalty, don’t just talk, show. For inspiration, take a look at American Express’ following tweet—a masterstroke of genius:

The brand encourages user-generated content on its X handle to let customers do the talking. It asks existing customers to share how and, more importantly, why they started their AmEx journey.

In response, customers can get their American Express card with the “Member Since” details embossed on the brand’s site.

Here are the learnings from this incredible customer retention campaign:

- Amplify your existing customer’s authentic testimonials on the right social media handle and gain goodwill

- Affirm your customers’ continued association and appreciate them socially to foster a sense of community

- Share the customer’s positive feedback internally to keep your team motivated

- Change things up with creative marketing campaigns if you feel that the existing customers are jumping ship out of monotony or boredom

The takeaway: Encouraging customers to share their stories creates powerful, authentic testimonials that enhance your brand’s credibility. Publicly acknowledging their loyalty strengthens community bonds and demonstrates genuine appreciation. Additionally, sharing this positive feedback with your team can boost morale and drive a customer-focused culture. Utilize these strategies to deepen customer loyalty and achieve sustainable growth.

Strategy #4: Reinforce ways to value your existing customer’s time

Loyal customers don’t want to spend time waiting to get their queries addressed.

If they want to cancel their subscription, they should be able to do it with one click.

If they want to get in touch with customer support, they should be able to talk to a live chat within seconds.

If they put up a complaint online on social media, they should get an action-oriented response within minutes, as Birkenstock demonstrates below:

As a thumb rule, brands must:

- Reduce the number of interaction channels to a minimum and enable customers to get their problems addressed as quickly as possible

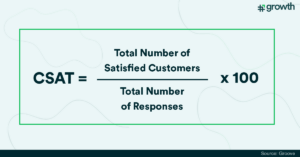

- Keep asking for customer feedback in real time and not look the other way if the responses are unpleasant

- Train agents to handle issues and empower them with the necessary permissions to take action promptly

- Focus on ironing out customer issues at first contact

- Implement self-service options such as comprehensive FAQs, video tutorials, and step-by-step guides to allow customers to self-serve

The takeaway: By making your customer service quick and convenient, you show your customers that you value their time. This will keep them happy and loyal for years to come.

Strategy #5: Focus on successful onboarding = Higher customer engagement = Retained customers

Brands rarely go back to the drawing board to analyze how their customers began their journey at the start—a big mistake.

Customer onboarding done right leaves a positive impression in the customer’s mind—one that lasts for a long time. But how do you deliver a seamless onboarding experience?

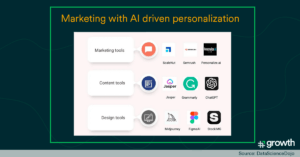

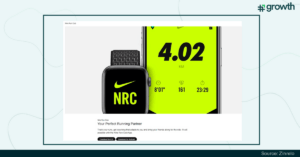

- Use AI-powered insights and analytics to gather real-time data on customer preferences and create omnichannel, personalized campaigns

- Automate your customer engagement efforts and lower manual effort to set up scalable campaigns

Use-case: How XL Axiata Drove a 29.5%Conversion Rate for Their Rewards Program

The challenge: XL Axiata, one of Indonesia’s largest telecom operators, needed an integrated customer engagement platform with advanced analytical capabilities to facilitate communications across all stages of the customer lifecycle.

The solution: The brand focused on building a robust onboarding strategy by:

- Leveraging AI-powered recommendations to:

– Optimize campaigns and flows with customer intelligence on customer behavior, action, and preferences

– Understand the best time to communicate with customers using the most preferred channels - Combining A/B testing and segmentation aggregation methodologies to boost the CTR rate

The results:

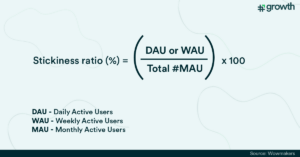

- 22% increase in app stickiness

- 26.2% increase in click-through rates via A/B testing on weekend deals

- 29.5% conversion rate of rewards program

The takeaway: To get customers hooked, you need to know what makes them tick. Brands must focus on leveraging AI-driven advanced insights on customer affinities to create relatable, value-driven customer retention campaigns.

Strategy #6: Be Thoughtful, mindfully

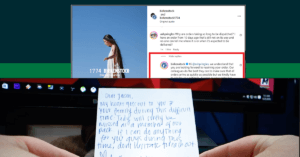

Sure, customers love freebies of any kind. But more than that, it’s the intent and thought that counts. Take BarkBox’s thoughtful gesture where it:

Refunded a customer’s advance payment for monthly subscriptions as their dog had died (with 4-5 months’ worth of subscription remaining)

Sent a sympathy card out of the blue to share the owner’s pain

The customer aptly described this as an act that “takes customer service to an entirely different stratosphere.”

How can brands be thoughtful without letting it dent the bottom line?

- Gifts don’t always translate to monetary value; personalized notes work better in some cases

- Focusing on small, meaningful actions to show you care helps. You can send handwritten thank-you cards, wish a customer happy birthday, give a surprise upgrade, or offer member-only discounts

- Provide early access to sales or new products for loyal customers

- Send personalized gifts and samples based on your customer’s past purchases from time to time

The takeaway: Acts of kindness never go unnoticed. The idea is to identify opportunities to surprise and delight the customer—as BarkBox did and build an emotional connection. If the situation demands, brands must empathize with their customers’ emotions. To elevate it, they must complement it with genuine gestures that will transform customers into self-confessed brand loyalists.

Strategy #7: Stick to your fundamentals, even if it means going bold

In 2021, the beauty brand Lush did something brands wouldn’t dare to do in today’s social media age— it turned its back on four social media handles: Facebook, Instagram, TikTok, and Snapchat.

Why did the brand take such a drastic step? By the brand’s own confession, it rolled out an anti-social media policy “until these platforms can provide a safer environment for their users.” The brand’s core target audience is young girls who are increasingly at risk of the negative mental effects of social media browsing.

What the brand did was:

- Prioritized the customer’s well-being over conventional marketing

- Aligned their audience’s needs with the brand’s offering to build a more authentic connection, even if it meant going against the grain.

Clearly, the lesson here is to first outline what your brand stands for and whether it makes sense for your target audience. If push comes to shove, brands should not hesitate to stand up for their values and make decisions that truly benefit their customers.

The takeaway: Sometimes, sticking to your principles means taking a bold stance, even if it goes against the norm. Lush’s move showed that prioritizing core values over popular trends can make a powerful statement and resonate deeply with your audience.

Are Your Customer Retention Campaigns Converting?

Every example of customer retention in this guide highlights the importance of focusing on your current customers—just as much as keeping an eye on your new prospects. While it’s tempting to prioritize new leads for a quick boost in revenue, it shouldn’t come at the expense of your returning customers.

One-time buyers won’t sustain your business; it’s the loyal, returning customers who act as your lifeline, especially in today’s unpredictable market. Use the customer retention strategies in this guide to create a robust revenue-generating retention campaign—one for the ages, really.

![How to Build a Brand and Customer Loyalty [#GROWTH19 Wrap-up]](https://www.hashgrowth.org/wp-content/uploads/2022/02/Building-Brand-and-Customer-Loyalty.png)

![How Marketing Automation Enhances Customer Experience in BFSI [Marketer Spotlight]](https://www.hashgrowth.org/wp-content/uploads/2022/02/How-Marketing-Automation-Enhances-Customer-Experience-in-BFSI.png)