#GROWTH helped me get an in-depth understanding of marketing automation and how to marry it with data and analytics to drive meaningful growth.

#ATTEND

#GROWTH Events

#Growth is an invite-only, exclusive community aimed at fostering growth & sharing new insights for growth marketers, product owners, entrepreneurs & CRM/analytics professionals from consumer brands.

Participating Brands from the Past Events

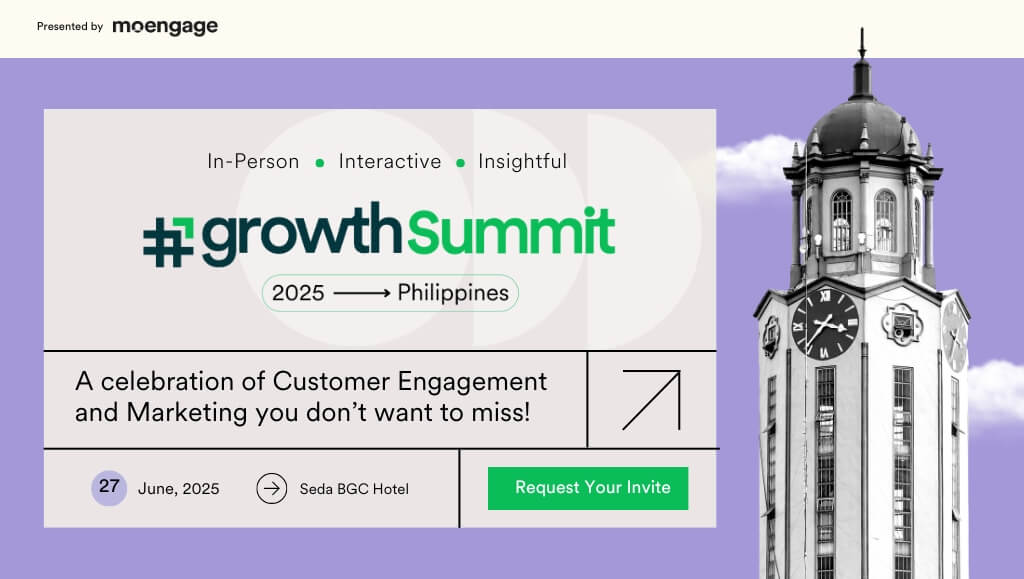

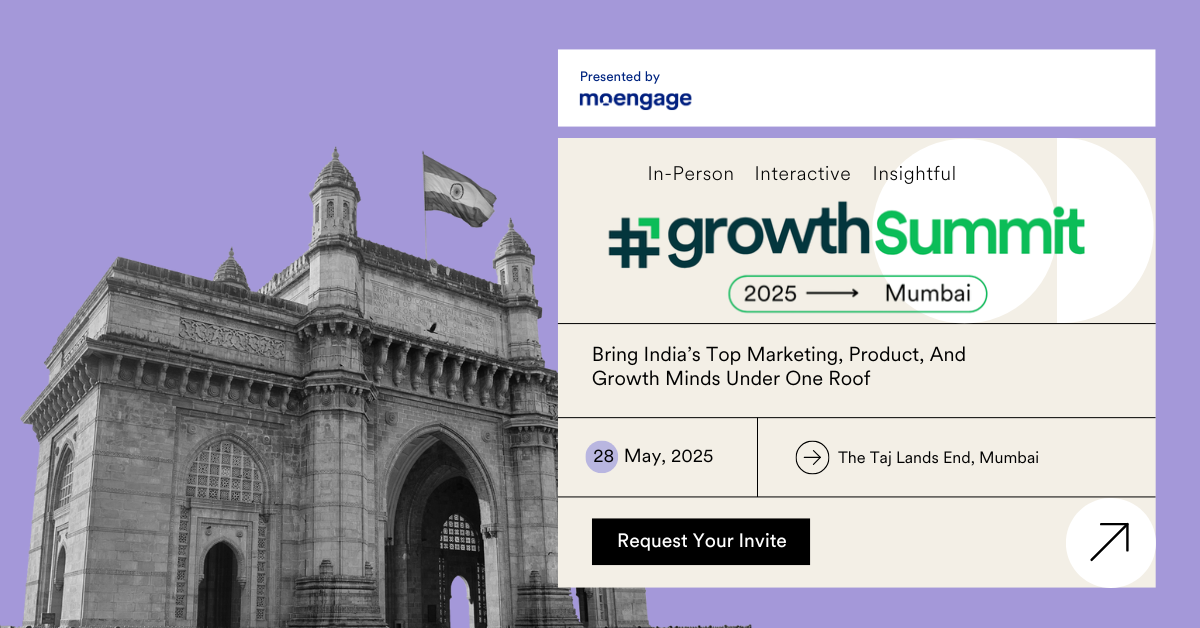

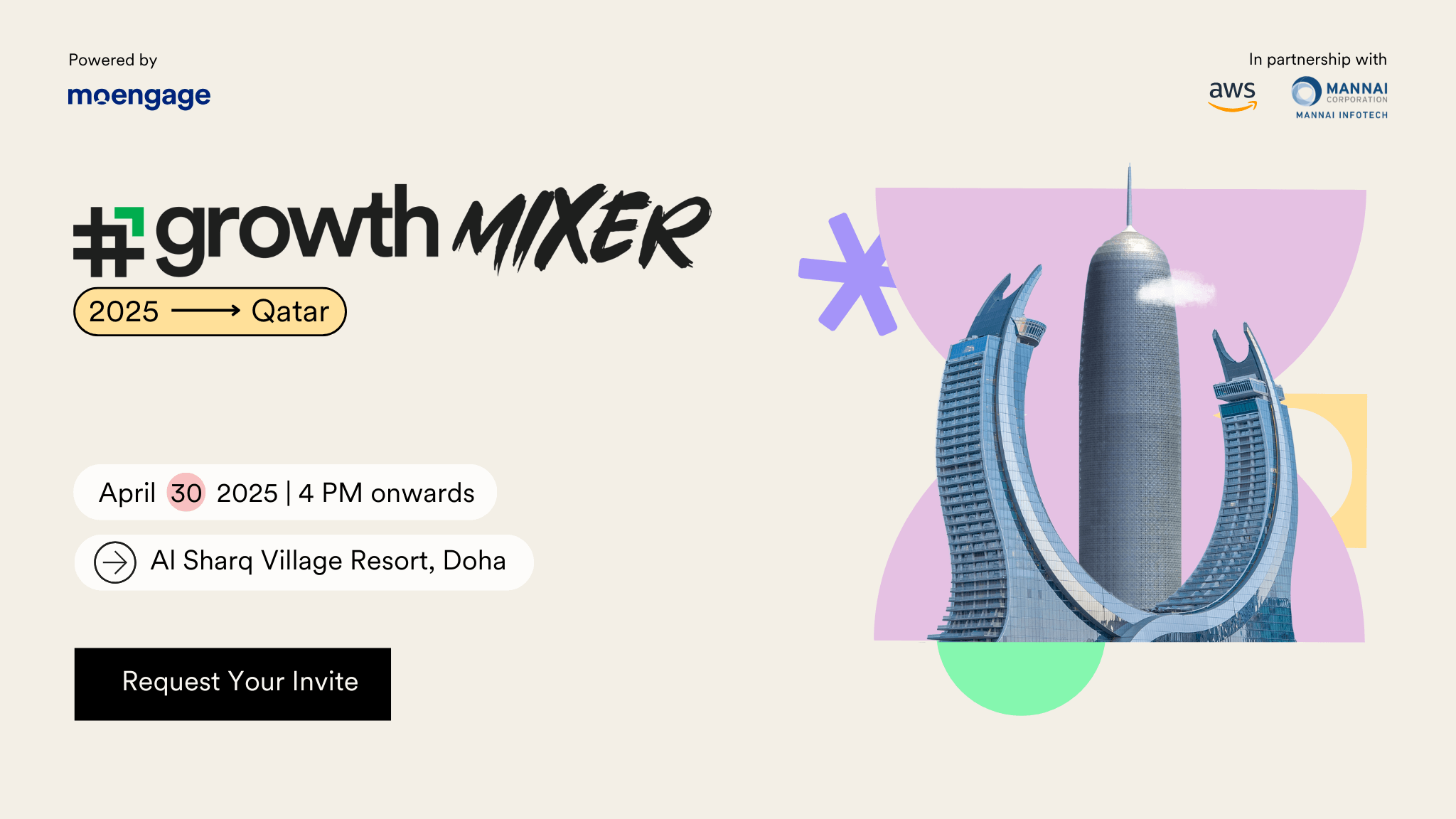

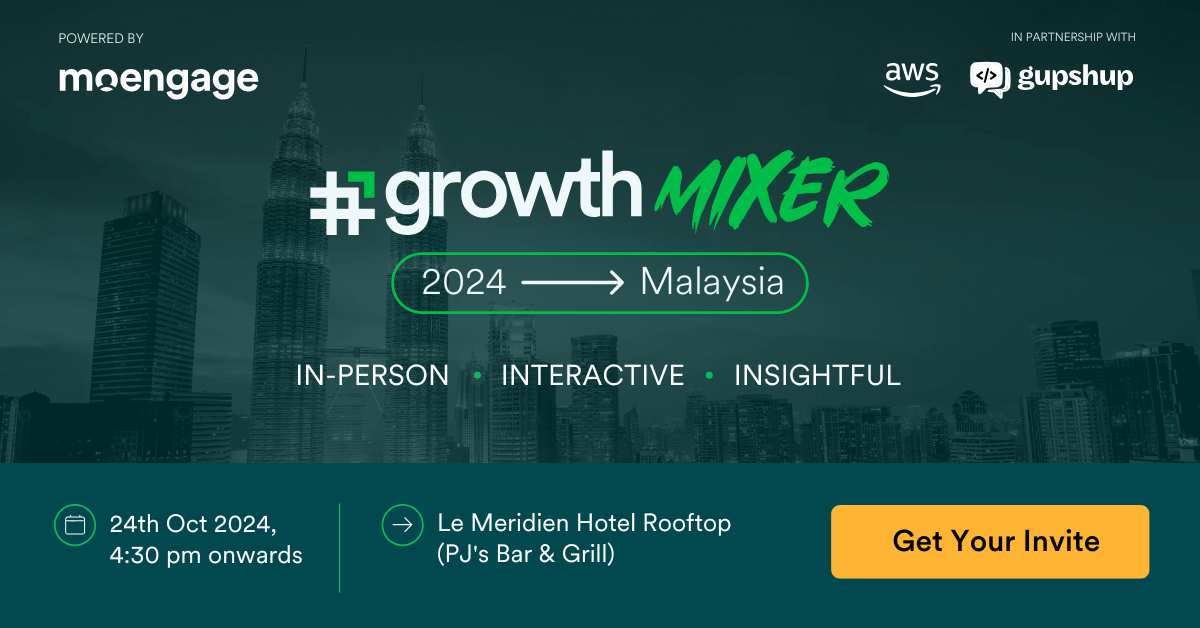

Upcoming Events

Check out the list of upcoming events here. We may be coming to a city near you!

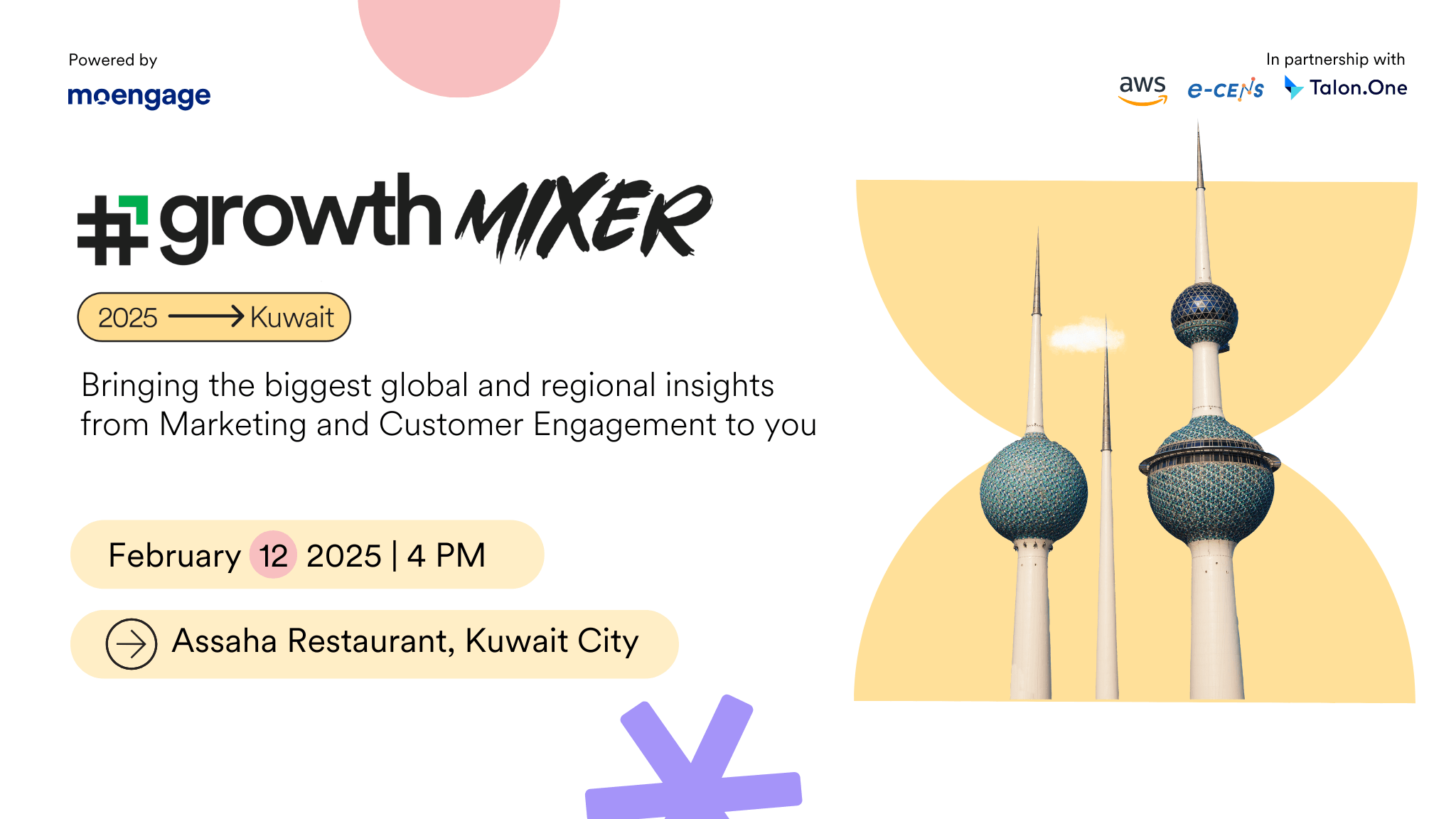

Past Events

We have hosted many successful events in various cities. Check out our list of past events to see where we’ve been. We hope to see you at one of our upcoming events!

Join the next #GROWTH event in a city near you to expand your network, learn from industry leaders, and up your growth game.

Community Chatter

This is what our #GROWTH peers have to say about their experience

I learned and understood more ways to tap into growth with #GROWTH courses. They're educative, interesting and a great way to learn and grow.

What we really like about this event is the chance to network, not only with fellow industry players, but also with future collaborators of Aladin.

I learnt a lot from other panelists and other speakers. I believe it will make a positive impact on the industry as well.

Finishing the #GROWTH certifications was helpful but I always saw great potential for a community and peer learning aspect. When the team reached out, I readily agreed.

The #GROWTH courses were superb – especially learning about user retention and growth marketing shifted my mindset towards engaging users rather than simply retaining them.

There's a wealth of knowledge and best practices out there that only a few big companies have access to. I love the idea of democratizing knowledge, sharing my learnings and learning from others in the industry.

I liked the fact that it was an interactive event with a diverse set of speakers. The topics covered were very relevant to the market.

#GROWTH Academy is user-friendly and easily digestible! I gained customer engagement strategies like automation, personalization, and analytics which benefit my role as the go-to digital marketing guy.